Back-to-School season feels like a new year to me.

Fresh lunch bags, new shoes, crisp notepads are all being collected for my kids to head back to school and, I’ll admit, a few of those fun new supplies are making their way into my home office too.

After a summer of relaxing, camping, vacationing, and living without a schedule, fall means getting things back in order. The kids are registered for swimming and art classes, I’m tempted by continuing education offerings in creative writing and analytics, and there’s even discussion of me joining my oldest at martial arts.

Fall is a time to start fresh with activities and routine and it’s when I find myself better prepared to tackle something like … new year’s resolutions.

THE BEST TIME FOR A NEW YEAR’S RESOLUTION IS NOW

Seriously! Why wait until January?! You’re in a mood to re-start, re-fresh, and swing back into routine, so why not add a resolution to the mix!?

Without having to entertain the boys, I’ll have more time for writing (the blog has slacked all summer) and working out (I haven’t run since the boys let out of school, my hours outside of work filled with dadventures to entertain). So I’m looking forward to getting my work and workout routines back, and I’m looking for other New Year’s Resolutions to tackle – like budgeting.

Having a more open schedule will help me with my first two resolutions, but the budget needs more work. I started a new job this year, working mornings on XL 103, and with it a new salary.

I have always ad libbed my pay stubs each week. I work out the big items first, like RRSP, mortgage, utilities, and RESP and then just trying to find the right balance for groceries, entertainment, dining out, charity, gas, bills over the next two weeks before I get paid again.

Not anymore.

AD LIB BUDGETING GETS STRUCTURE

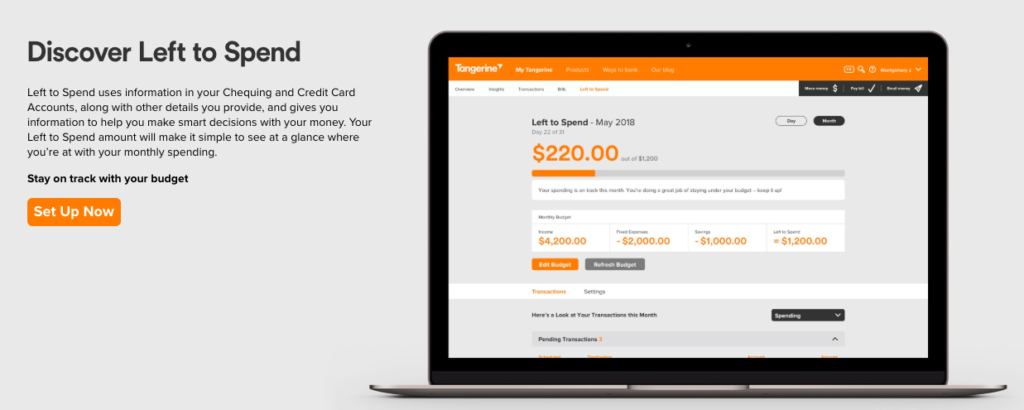

Tangerine has a new simple feature that helped me figure out my balance sheet. Left To Spend asks you simple questions about what comes in and what goes out each month. You input the figures and then you understand exactly how much you have “LEFT TO SPEND!”

I’ll admit, there were times in the past, when I had to delay a payment for a few days to make my next cheque, or get my wife to cover something off because I hadn’t planned. The new Left To Spend budget feature has me understanding exactly what’s coming in and what’s going out.

First I inputed my monthly income, and then I just worked through the categories where I spend money each week. I inputed mortgage payments, utility bills, groceries, gas, etc.

Then I moved on to my set savings plans like my RRSP and RESP

With my mortgage coming up for renewal in the spring, I now have an exact idea of how much I can afford as I try to wipe out my debt within a decade. AND .. it also helps me know how much I have Left To Spend for last second splurges. Maybe it’s concert tickets, a family night out at the movies (not cheap), or a celebratory dinner.

Before I budgeted and worked through things in real time, I could be dipping into tomorrow to have fun today. Left To Spend has me staying on track and learning better planning.

VISUALIZATION WILL HELP YOU HIT YOUR GOAL

Tangerine’s Goal feature is like your own digital vision board. If you want something to happen, you need to visualize it coming true. The feature sets up automatic transfers weekly, bi-weekly, or monthly to help your savings goal.

Maybe you’re saving for a wedding, home renovations, or a big vacation? Me, I’m all in for some new skis.

So I set that big picture of someone crushing powder, and dream that it’s me.

The automatic transfer is like a dripping faucet, it pulls a little bit at a time, but eventually it pools together to form something substantial. In my case, that’s $400 for some new skis.

With a budget set up to keep me on track for my long term planning (as well as letting me know how much I have Left To Spend for last minute splurges), and a short term automatic saving tool helping me hit my goals of more family time on the hill this winter, Tangerine has me ready for a new year!

This post is sponsored by Tangerine

Tangerine takes pride in its purpose to help Canadians live better lives by enabling them to make smarter decisions with their hard-earned money.

Tangerine believes that Canadians deserve more money from their everyday banking experience and more money in their pockets. Whether it’s through their spending, saving, investing, or borrowing products, Tangerine offers great rates, no unfair fees, and award-winning client service – all while keeping the client experience at the heart of everything they do.

Your money should work as hard as you do, and you shouldn’t have to work hard to make that happen.

Tangerine. Earn More. Save More. Keep More. Forward Banking.